Trade the most popular CFDs on Commodities from around the world, including energies, agriculture and metals. FxAdmiral.com combines tight pricing and flexible conditions to give you one powerful product.

In the past, the futures market has been the most direct way to access trading in commodities. Futures contracts are legal agreements to Buy or Sell a particular commodity at a predetermined price and at a specified time in the future, and they generally demand a larger allocation of capital.

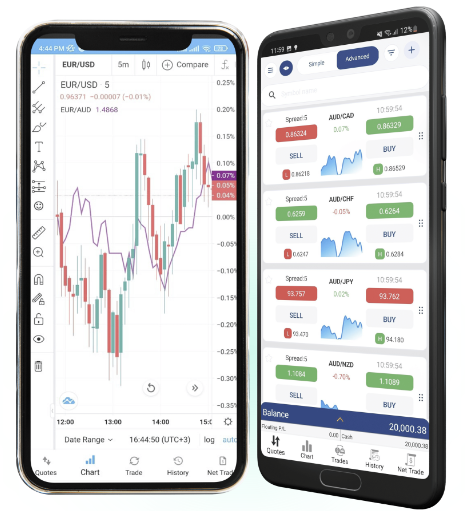

Another method for the modern-day commodities investor is to trade via contracts for difference (CFDs). Before exploring this method, it is important to understand what CFDs are. CFDs are derivatives between two parties; a buyer and a seller, or a trader and a CFD provider (like Plus500) that states that the buyer must pay the seller the difference between the current value of the financial instrument and its value at the time the contract is entered into.

CFDs are a derivative product that allows traders to speculate on the price movements of the underlying instrument without taking actual ownership of the product itself. Furthermore, CFDs are considered an efficient way to trade popular commodities - such as Oil, Natural Gas, Gold or Silver - due to higher leverage, which enables a trader to use less capital to gain greater exposure to an underlying instrument, increasing potential for losses as well as profits.

Over 22 CFDs on Commodities to trade

Over 22 CFDs on Commodities to trade Gold,Silver

Gold,Silver Spot and Futures CFDs

Spot and Futures CFDs Up to 1:1000 leverage

Up to 1:1000 leverage Deep liquidity

Deep liquidity Trade 24 hours a day, five days a week

Trade 24 hours a day, five days a week

CFDs on Commodities cover energy, agriculture and metals products. These products are traded in futures markets and derive their value from demand and supply characteristics.

Supply characteristics include the weather in the case of agriculture and costs of extraction in the case of mining and energies.

Demand for CFDs on Commodities tends to be characterised by broader conditions such as economic cycles and population growth. CFDs on Commodities can be traded as stand alone products or in pairs.

We have the most popular & convenient payment methods for fast deposits & withdrawals